We use some essential cookies to make our website work properly.

We’d also like to set additional cookies to help us improve our website, tailor marketing and provide a more personal experience.

Expert review by Rachel East

Senior Director of Later Life Advice at Key Equity Release

Equity release is no longer a financial niche. It’s a growing part of modern later-life finance planning. As UK homeowners face the squeeze of rising living costs, more turn to property wealth for the answer. It gives access to products with flexible features and lets them stay living in the home they've built and love.

Today’s equity release plans have evolved too. The lifetime mortgages we recommend can help you manage your total cost of borrowing. From optional repayments to drawdown features, they're more adaptable to changing needs.

But what are people actually using equity release for? And how are those priorities shifting over time?

To answer that, we’ve analysed over 1,000 of our customers from Q2 2024 to Q1 2025, drawing on exclusive first-party data. This report explores:

Equity release allows UK homeowners aged 55+ to unlock part of their property’s value as tax-free cash, without needing to move.

There are two main types of equity release:

Want a quick overview? Our guide to equity release explains how the products work and the protections in place.

People use equity release for a range of reasons. Common motivations include:

Some also allocate funds to discretionary goals like the trip of a lifetime or buying a new car. It’s important to consider the effects of compound interest on lifetime mortgages especially when borrowing for non-essential spending — taking more than you need, earlier, can increase the total cost over time. Features like drawdown and optional repayments can help manage this.

We use our own internal data to give a clear view of what’s happening now and how that has changed:

For a high-level sense check, our equity release calculator can give you an illustrative estimate of what you could release. This is separate from the findings presented here.

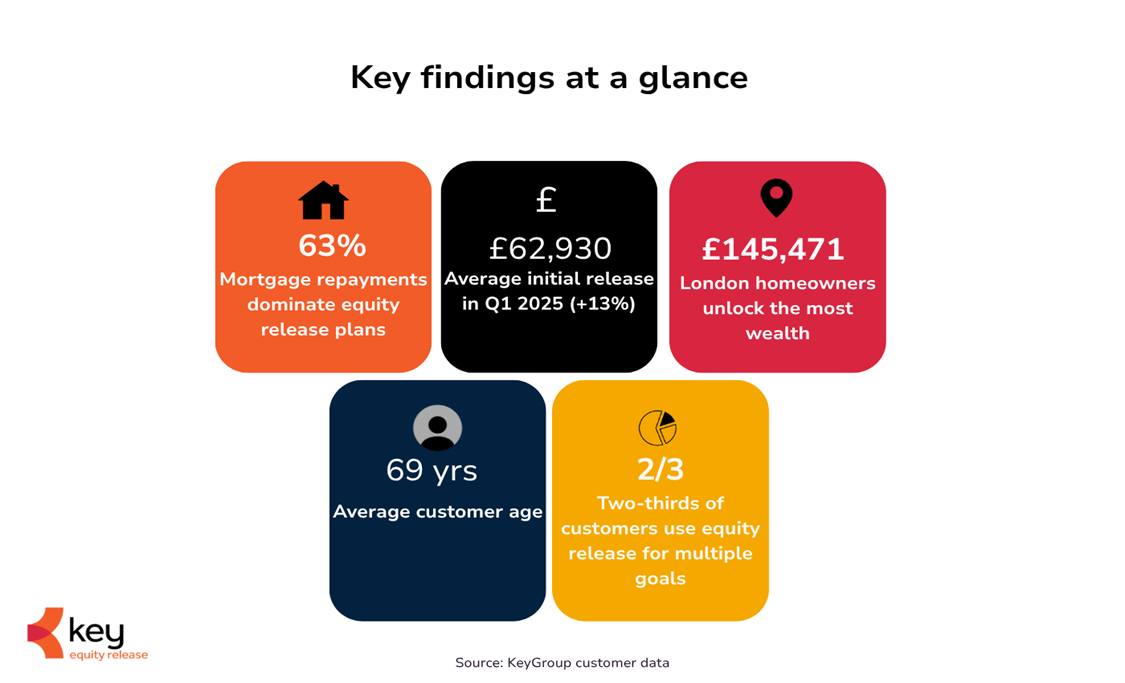

Mortgage repayments dominate: 63% of equity release plans in Q1 2025 were used to clear existing mortgages — up from 36% in Q2 2024.

Initial withdrawals rise: The average initial release increased +13.3% year-on-year to £62,930, even as total facilities fell to a four-year low.

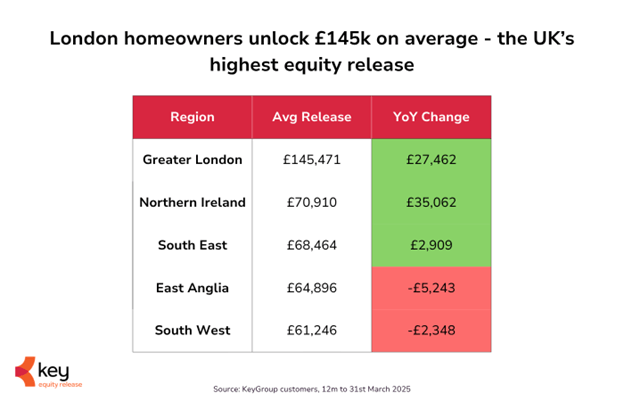

London leads, East Anglia slows: Londoners released the UK’s highest initial amounts at the end of Q1 2025 (up £27,462), while East Anglia registered the biggest drop in YoY amounts (down £5,243).

London tops average initial releases: Londoners released an average of £145,471 per plan at the end of Q1 2025 — the highest in the UK.

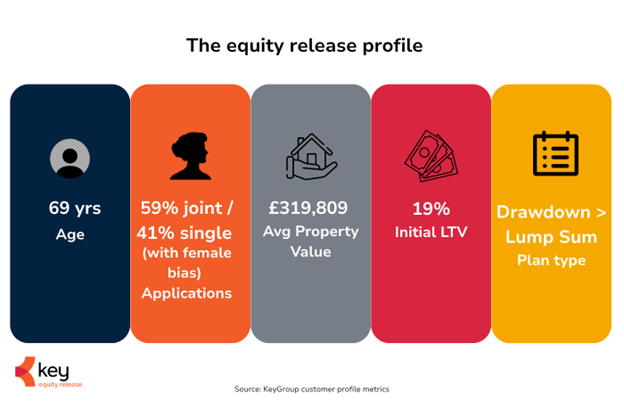

A changing customer profile: The average customer is now 69 years old, 59% apply jointly, and single women cases outnumber single men cases (592 vs 423).

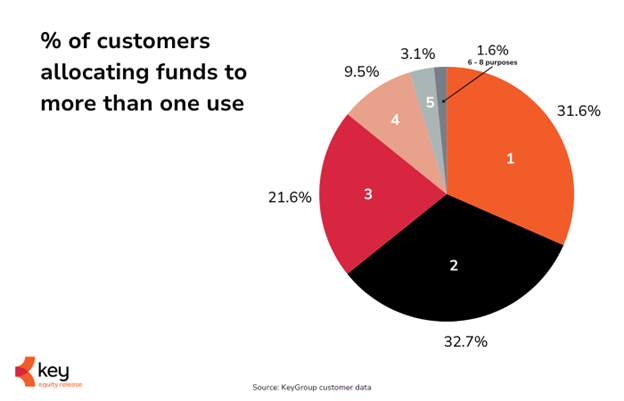

Planning, not panic: Two-thirds of customers spread funds across multiple goals, showing equity release is increasingly used as a financial planning tool.

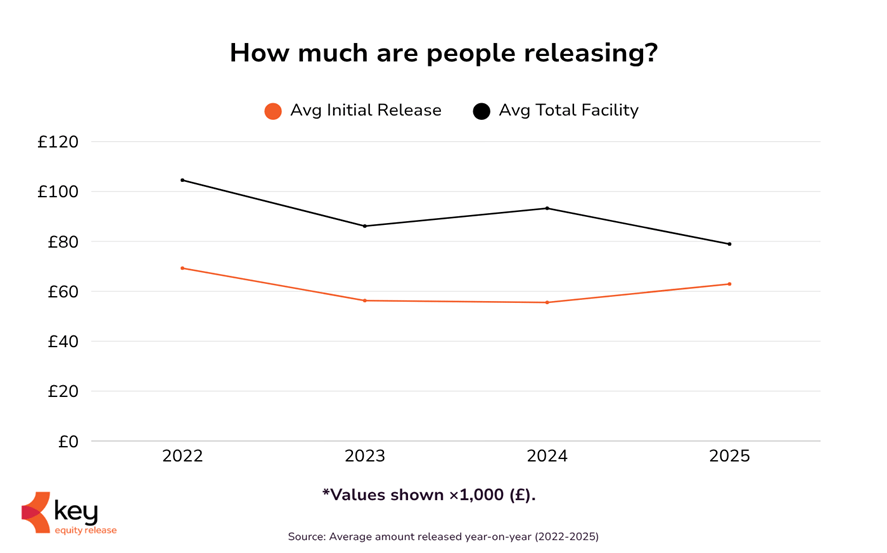

In 2025, the average initial release rose for the first time in three years, increasing +13.3% year-on-year to £62,930. However, the average total facility (initial release plus approved drawdown facility) fell to a four-year low of £78,942 — down 15.4% year-on-year and 24.5% since 2022.

This shift could be attributed to a sharp drop in the average drawdown facility set up alongside the release — from £37,744 in 2024 to just £16,012 in 2025 (a 57.6% decrease).

As a result, initial releases now make up nearly 80% of the total facility (up from ~60% in 2024), suggesting a move toward:

Customers are front-loading more of their borrowing to meet immediate financial needs — such as repayment of an existing mortgage or essential expenses. While setting aside less for future flexibility.

This shift underscores the short-term pressures on household finances in 2025. Where certainty and liquidity take precedence over optional drawdown facilities. It also suggests many households are choosing to tackle specific financial needs upfront. Rather than keeping a drawdown facility in place for future spending.

A lifetime mortgage may result in limited or no property equity remaining. This will reduce your financial options in the future.

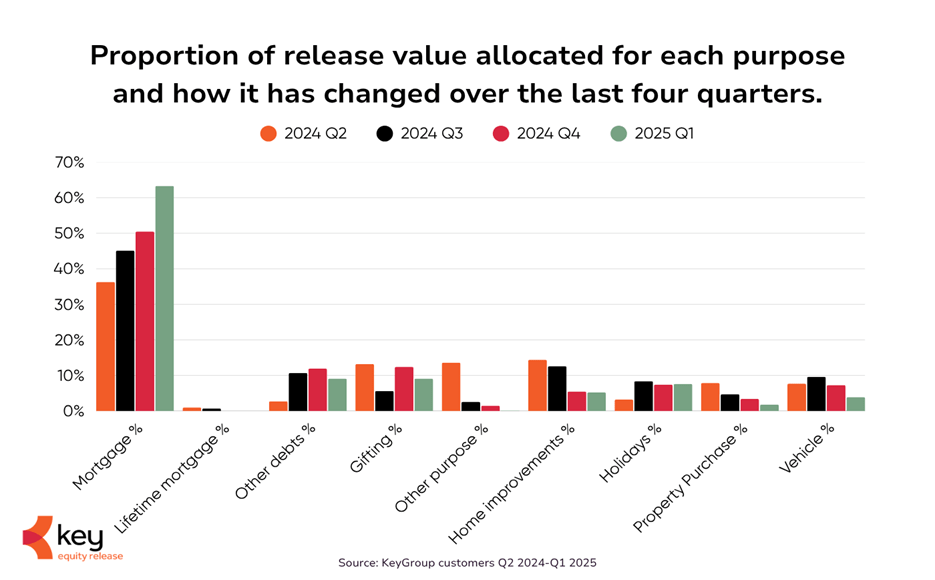

The latest data reveals a sharp shift in how homeowners are using equity release. In Q1 2025, the majority of plans were being taken out to repay an existing mortgage. Uses such as property purchases and vehicles have fallen back.

Between Q2 2024 and Q1 2025, the proportion of customers using equity release primarily to repay a mortgage jumped from 36% to 63%. This makes it the single dominant motivation. This is a clear reflection of households prioritising financial stability amid higher interest rates and tighter budgets.

By contrast:

Some categories remain more resilient. For example:

The picture is clear: equity release has become more about financial resilience. Rising rates and ongoing cost-of-living pressures are pushing households to use some of their property wealth to manage essentials first (particularly mortgages) while deferring or reducing spending on many discretionary goals.

This reinforces the view of equity release as a strategic financial tool and one that is increasingly being deployed to safeguard day-to-day financial stability.

While spending on home improvements has dropped overall, it’s important to draw a distinction between “vanity projects” such as conservatories or cosmetic upgrades, and adaptations that make homes more suitable for later-life living.

Investments in accessibility, energy efficiency, or safety can make financial sense when compared with the cost of moving. They also bring emotional benefits, like staying close to family and support networks.

These kinds of improvements can also help to protect — or even increase — the value of your home. That makes them a sensible choice not only for everyday living but also for long-term financial planning.

Although most funds are still directed to essential goals, there’s been a clear uptick in holidays as a primary purpose. Holiday-related plans more than doubled over the year, rising from 3.2% in Q2 2024 to 7.6% in Q1 2025. This suggests some customers are reserving a portion of their release for quality-of-life experiences alongside core financial needs.

With lifetime mortgages, remember the interest compounds — drawing more, or earlier, can increase the total cost over time. Features like drawdown and optional repayments can help manage this.

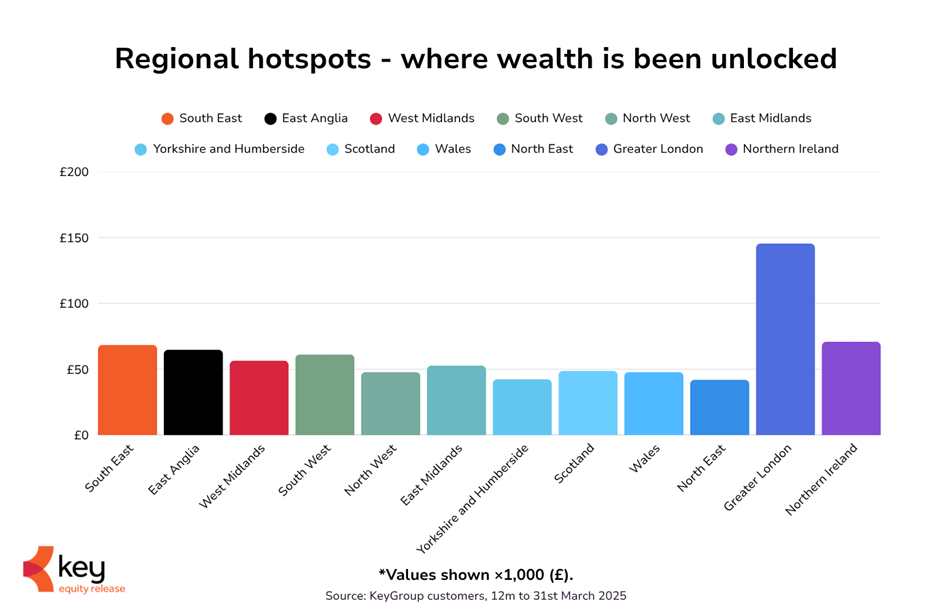

Equity release looks very different depending on where you live. Our analysis shows which regions have the highest volumes and where homeowners are releasing the largest sums. It also highlights how these patterns are changing over time.

Londoners released an average of £145,471 per plan in 2025. More than double the UK regional average and the highest in the UK by far.

That’s a jump of more than £27,000 on the year before, showing how London’s property market continues to fuel the largest equity withdrawals.

East Anglia has been one of the UK’s most active regions for equity release. In the 12 months to March 2025, 124 households released an average of £64,896 each, putting the region firmly among the top users.

But compared with the year before, activity has fallen dramatically. Case volumes halved year-on-year (from 247 to 124), and the average amount per plan fell from £70,138 to £64,896 (−£5,243). As a result of the lower number of plans, the total value released fell by £9.2m year-on-year. This points to fewer households turning to property wealth in East Anglia, potentially reflecting softer housing activity and increased caution.

The East Midlands also saw a sharp fall in cases, from 300 plans in 2024 to just 86 in 2025. However, the average release amount has remained almost unchanged at £52,776.

This pattern points to a contraction in overall demand rather than smaller withdrawals. Homeowners who did unlock wealth tended to release similar sums to the year before.

In the North East and North West, the story is one of resilience and growth.

In the North East, the average release rose modestly to £42,123, up by more than £1,200 year-on-year.

In the North West, the increase was even more pronounced, from £42,488 in 2024 to £47,937 in 2025.

Together, these regions accounted for over 150 cases in 2025, showing that demand for equity release is also prevalent outside the South.

The average customer is 69 years old, reflecting equity release’s growing role as a mainstream option in later-life financial planning.

This exceeds the traditional retirement age of 65, indicating that homeowners are increasingly turning to their property wealth later in retirement.

The majority of cases in 2025 were joint applications (59%). Typically couples arranging their finances together. However, 41% of customers applied individually, and among them, women made up the majority (592 single women vs 423 single men).

The average home value among customers was £319,809, with initial borrowing typically set at just 18.9% of that value. This low loan-to-value (LTV) highlights the conservative nature of most plans. Customers are only unlocking a small portion of their property wealth.

Flexibility is a clear priority for customers in 2025:

This suggests many homeowners prefer to access funds in stages, drawing down only what they need when they need it following an initial lump sum, rather than taking the entire facility upfront. However, it's important to note that a drawdown facility isn’t guaranteed. It's subject to the prevailing interest rate at the time the funds are released.

Equity release customers are getting younger, more diverse, and more strategic in how they use the product.

Equity release in 2025 is often used for more than one purpose. While some homeowners use it to tackle one pressing need, most are spreading funds across multiple goals. Turning their housing wealth into a flexible planning tool rather than a one-off fix.

Around a third of customers (31.6%) used their plan for just one purpose, often to clear an existing mortgage or repay existing debts. But for the majority, the picture is far more varied. The largest group (32.7%) divided their release between two different uses, while another one in five (21.6%) spread funds across three priorities. Almost one in ten (9.5%) allocated their release to four or more purposes.

This means that two-thirds of customers are now using equity release to address multiple priorities at once. For many, that might mean repaying a mortgage and helping children, or covering living costs while also investing in essential home improvements.

And crucially, while the focus is increasingly on needs, customers are still leaving room for life’s pleasures. The data shows that even in a climate of higher interest rates and rising household bills. A portion of released funds continues to be set aside for holidays.

Taken together, this behaviour underscores a shift in how equity release is perceived and used. It's no longer a product of last resort. It can be a strategic way to balance financial security with a fulfilling retirement.

You should always think carefully before securing a loan against your home to repay existing debt. Equity release may affect your entitlement to means-tested benefits.

Equity release in 2025 is about evolution and balance. Helping households manage immediate pressures while still supporting long-term goals.

The dominant motivation today is mortgage repayment, reflecting the heavy burden of monthly costs and the desire for financial stability. Alongside this, some families are also using equity release to reduce other existing debts. This needs careful consideration as it involves securing borrowing against the home.

Many also use funds to support loved ones or to invest in their properties — often making them more suitable for later life living. These choices highlight how equity release is being used as a form of financial resilience. This keeps people secure in the homes and communities they value.

But resilience is only half the story. The data also shows that many customers are spreading funds across multiple priorities. Reserving a portion for enjoyment and fulfilment. Whether that’s a holiday or simply easing everyday pressures. Equity release is enabling people not just to survive retirement. But to live it well.

Taken together, these findings show how equity release has matured into a flexible, multi-purpose planning tool. It offers both financial security and the freedom to enjoy life. This positions property wealth as a central pillar of retirement planning in 2025 and beyond.

As the market continues to evolve, having the right support has never been more important.

At Key, our equity release advisers are here to help you explore how releasing equity could fit into your wider retirement plans — offering honest, personal, and trusted guidance every step of the way. And if equity release isn’t right for you, we’ll tell you.

All our equity release advice relates to lifetime mortgages only. Our fixed advice fee of £1,699 is payable on completion of a plan.

Your other options with Key: Key Group offers alternatives to equity release such as a retirement interest-only mortgage or retirement repayment mortgage. If another product is more suitable, we'll refer you to a different specialist adviser within Key Group who can help. If you go ahead, you'll never be charged more than our standard fixed advice fee of £1,699, even if their fee is higher.

Other options to think about: It's important to know your other options before going ahead with equity release. These include: downsizing, unsecured lending, using existing assets, or support from friends or family.